France Plant-Based Dairy Market Report: Trends, Growth and Forecast (2026-2032)

By Product Type (Plant-Based Milk (Soy Drinks, Almond, Blends, Coconut, Oat, Rice, Other Plant-Based Milk), Plant-Based Yoghurt, Plant-Based Cheese), By Sales Channel (Retail Offline (Grocery Retailers, Convenience Retailers, Supermarkets, Hypermarkets), Retail Online)

- Food & Beverage

- Feb 2026

- VI0884

- 125

-

France Plant-Based Dairy Market Statistics and Insights, 2026

- Market Size Statistics

- Plant-based dairy in France is estimated at USD 490 million in 2025.

- The market size is expected to grow to USD 545 million by 2032.

- Market to register a cagr of around 1.53% during 2026-32.

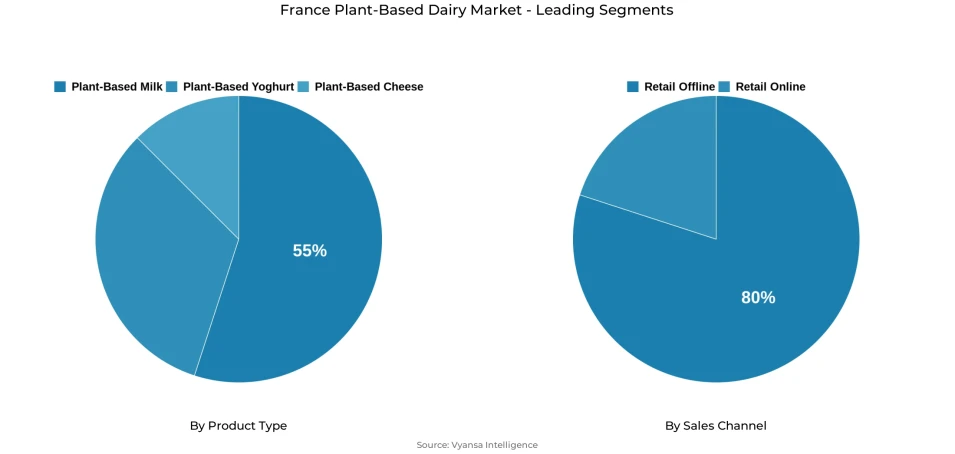

- Product Type Shares

- Plant-based milk grabbed market share of 55%.

- Competition

- More than 10 companies are actively engaged in producing plant-based dairy in France.

- Top 5 companies acquired around 65% of the market share.

- Fromageries Bel SA; Upfield France SAS; Oatly France SAS; Bjorg & Cie SA; Olga SAS etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 80% of the market.

France Plant-Based Dairy Market Outlook

The France plant-based dairy market is forecasted to remain with its steady growth throughout the forecasted period. The market is estimated to be valued at USD 490 million in 2025, forecasted to further grow around USD 545 million by 2032 with the growing flexitarian trend. The plant-based milk market is expected to account for the majority, particularly oat-based ones, whereas plant-based cheese is forecasted to experience the fastest growth owing to its smaller share and its adoption by flexitarian end users who want to have the chance to cook a variety of dishes.

In the French market, there are more than 10 players who are actively pursuing plant-based dairy production, while the top five companies control around 65% in the market. Top brands, including Bjorg & Cie SA, continue to retain their presence in diverse product offerings, organic range, and all-encompassing distribution in the retail markets. Rival players are also diversifying their product portfolio by launching new products, altogether varying in taste, nutrition, and pricing for the varied group of end users.

The retail offline is the primary mode of selling and accounts for 80% of activity, with most offline retail sales facilitated through hypermarkets, supermarkets, and discount stores. Organic supermarkets provide a wide assortment of vegetables and retail e-commerce business is gaining popularity among the end end users, especially among younger generations who understand its convenience and availability of niche products.

The areas of sustainability, labelling, and sourcing would continue to evolve the products. The market would require the delivery of needs on basic ingredients, eco-friendly practices, along with the need for superior taste, which would help the companies achieve a competitive advantage. The areas of further innovation, such as plant cheese, would drive the market, thus facilitating the end users’ preferences for a change in France.

France Plant-Based Dairy Market Growth DriverIncreasing Health Consciousness and Transition into Sustainable Diets

The France Plant-based Market is predominantly swayed by a positive adaptation to the growing need for health realization and sustainable eating habits. The French end users are reducing their intake of animal-based products because of the concern of high cholesterol, lactose intolerance, and environmental systematic effects that derive from regular milk. The need for plant-based alternatives, which turn out to be highly nutritious and environmentally sound, gets amplified significantly. The flexitarian diet has also become quite in vogue, where end users are induced to strike a delicate balance between eating delicious foods as well as nutritious foods by controlling animal-based product intake. The cultural shift that makes people aware of eating habits makes plant-based milk an absolute necessity in a balanced diet.

The concern for the environment is one of the main market trends, and there is an increasing share of French families who are interested in these products, which refer to sustainability and moral responsible sourcing. Various types of oat, soy, and nut-based milks, which are produced locally, are also alluring, as this will aid the reduction of emissions from transport and will give a boost to local agri-business. This shift has been assisted by the efforts of the French government regarding the promotion of the low carbon food system and the increasing debate on climate change. Due to the convergence of health and sustainable trends seen within the market trends of purchases, plant-based dairy is becoming increasingly popular within its targeted market group.

France Plant-Based Dairy Market ChallengePricing Sensitivity and Ingredient Limitations

The France plant-based dairy market faces a notable constraint due to the relatively premium pricing and positioning of these products compared to conventional dairy options. This is particularly the case for portfolios such as almond-based and soy-based beverages in which affordability of the price-sensitive end user is relatively low due to cost constraints. Market competition is becoming increasingly important as the market develops without alienating end users.

Concerns related to the ingredients are still in play too. Soy beverages with high nutritional values are still facing the competition related to prices, owing to the limited capacity and the regulation factor that causes hindrances to the flexibility provided to the manufacturing end regarding the formulation and pricing that evoke inhibiting factors for the wider community to adopt them with less sensitivity to price changes when compared to dairy products.

France Plant-Based Dairy Market TrendShift Toward Clean-Label, Locally Produced Plant-Based Dairy Shapes Market Preferences

End users taste is now turning to vegetarian dairy alternatives with a focus on local sourcing and minimal processing and openly declared ingredient origins. Made in France positioning is a very strong positioning, as end users will identify sustainability and minimal environmental footprints with locally produced goods, and this has led to a corresponding expansion of locally-grown vegetarian plant-based materials available in local shops.

Clean labelling is also on the rise due to the investigation of the formulas from the end users. Products, which are centered on simplicity, naturality, and careful attention, are considered acceptable. Those companies, which are able to incorporate the elements of taste, sustainability, and localness, have better opportunities to win the trust and establish stable growth in the market for plant-based dairy products in France.

France Plant-Based Dairy Market OpportunityPlant-Based Cheese Is Set to Emerge as a High-Potential Growth Avenue

A significant growth avenue within the France plant-based dairy market lies in the expanding potential of plant-based cheese. Although it is smaller in size compared to other categories, it is also momentum-driven in terms of flavors and cooking suitability. Unlike milk alternatives, cheese also targets flexitarians who want something to share while eating.

Opportunity is further boosted through changes occurring in the competitive environment. With the departure of the old players, the room is now set for new product launches, reformulation, and consolidation. End users taste, clean labelling, and culinary functionality are among the core traits that can easily be leveraged by brands and thus conquer the demand and settle their supremacy within this new segment

France Plant-Based Dairy Market Segmentation Analysis

By Product Type

- Plant-Based Milk

- Soy Drinks

- Almond

- Blends

- Coconut

- Oat

- Rice

- Other Plant-Based Milk

- Plant-Based Yoghurt

- Plant-Based Cheese

The segment has the highest market share under the product Type is plant-based milk, accounting for around 55% of total plant-based dairy share. This dominance is mainly driven by strong demand from flexitarian end users, who see plant-based milk as an easy and familiar alternative to traditional dairy. Taste remains a decisive factor, and products that fail to match dairy in flavour risk being substituted with conventional milk. Oat milk performed particularly well due to its European origin, which aligns with end users interest in sustainability and reduced environmental impact.

Soy milk also recorded notable growth, supported by its high protein content and low sugar and fat levels, despite higher prices. Almond milk faced pressure due to pricing and limited local sourcing. While plant-based cheese showed faster growth, plant-based milk continues to lead due to its broad usage, availability, and strong acceptance among non-vegan end users.

By Sales Channel

- Retail Offline

- Grocery Retailers

- Convenience Retailers

- Supermarkets

- Hypermarkets

- Retail Online

The segment has the highest market share under the Sales Channel is retail offline, contributing around 80% of total share. Grocery retailers such as hypermarkets, supermarkets, and discounters remain the primary purchase points for plant-based dairy products, offering wide accessibility and strong visibility. Specialised organic supermarkets also play an important role by providing a broader assortment, particularly for organic plant-based milk, even as the organic segment faced challenges during the review period.

Convenience stores recorded the strongest value growth, supported by rising demand for proximity shopping. Although retail online holds a higher share for plant-based dairy than for traditional dairy, retail offline continues to dominate due to immediate availability and established shopping habits. The strong presence of plant-based dairy across physical retail formats continues to underpin sales growth in France.

List of Companies Covered in France Plant-Based Dairy Market

The companies listed below are highly influential in the France plant-based dairy market, with a significant market share and a strong impact on industry developments.

- Fromageries Bel SA

- Upfield France SAS

- Oatly France SAS

- Bjorg & Cie SA

- Olga SAS

- Sojinal Alpro Soya SA

- Andros SAS

- Carrefour SA

- Groupe Léa Nature

- Alterfoodie SAS

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. France Plant Based Dairy Market Policies, Regulations, and Standards

4. France Plant Based Dairy Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. France Plant Based Dairy Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Plant-Based Milk- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Soy Drinks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Almond- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Blends- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Coconut- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.5. Oat- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.6. Rice- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.7. Other Plant-Based Milk- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Plant-Based Yoghurt- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Plant-Based Cheese- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Sales Channel

5.2.2.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.2.1.1. Grocery Retailers- Market Insights and Forecast 2022-2032, USD Million

5.2.2.1.2. Convenience Retailers- Market Insights and Forecast 2022-2032, USD Million

5.2.2.1.3. Supermarkets- Market Insights and Forecast 2022-2032, USD Million

5.2.2.1.4. Hypermarkets- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Competitors

5.2.3.1. Competition Characteristics

5.2.3.2. Market Share & Analysis

6. France Plant-Based Milk Market Outlook, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. France Plant-Based Yoghurt Market Outlook, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. France Plant-Based Cheese Market Outlook, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.Bjorg & Cie SA

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.Olga SAS

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.Sojinal Alpro Soya SA

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.Andros SAS

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.Carrefour SA

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.Fromageries Bel SA

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.Upfield France SAS

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.Oatly France SAS

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.Groupe Léa Nature

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. Alterfoodie SAS

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.