Global Agricultural Drones Market Report: Trends, Growth and Forecast (2026-2032)

By Offering (Hardware (UAV Frames & Airframes (Fixed-Wing Drones, Rotary Blade Drones, Hybrid Drones), Propulsion Systems, Payload Systems (Cameras, Multispectral, LiDAR Sensors), Spray Systems & Nozzles), Software (Flight Planning & Control Software, Data Analytics Platforms, Crop Health Monitoring Tools), Services (Maintenance & Repair, Training & Support, Data Interpretation & Consultancy)), By Application (Crop Monitoring & Surveillance (Aerial Imaging, Multispectral & Hyperspectral Analysis, NDVI Mapping), Precision Spraying & Fertigation (Pesticide Application, Fertilizer Distribution, Targeted Herbicide Spraying), Soil & Field Analysis (Soil Moisture Mapping, Topography & Field Mapping), Planting & Seeding (Drone-based Seeding Systems, Automated Seed Disbursement), Others (Livestock Monitoring, Soil Health Analytics, Research & Development Applications)), By Payload (Up to 2 kg Payload Drones, 2 kg to 20 kg Payload Drones, 20 kg to 50 kg Payload Drones, Above 50 kg Payload Drones), By Range (Visual Line of Sight (VLOS), Beyond Visual Line of Sight (BVLOS)), By Technology Type (Thermal Imaging, Multispectral Imaging, Hyperspectral Imaging, Light Detection and Ranging (LiDAR), RGB Imaging, Synthetic Aperture Radar (SAR), Near-Infrared (NIR) Imaging, Global Navigation Satellite System (GNSS)), By Region (North America, Latin America, Europe, Middle East & Africa, Asia-Pacific)

- Agriculture

- Dec 2025

- VI0495

- 185

-

Global Agricultural Drones Market Statistics and Insights, 2026

- Market Size Statistics

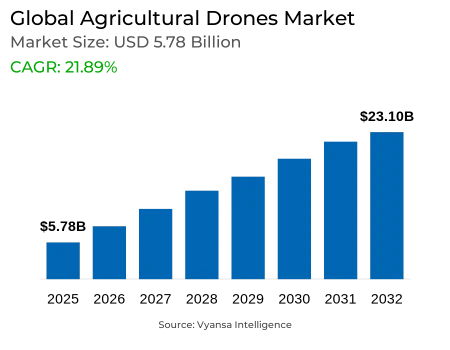

- Global Agricultural Drones Market is estimated at $ 5.78 Billion.

- The market size is expected to grow to $ 23.1 Billion by 2032.

- Market to register a CAGR of around 21.89% during 2026-32.

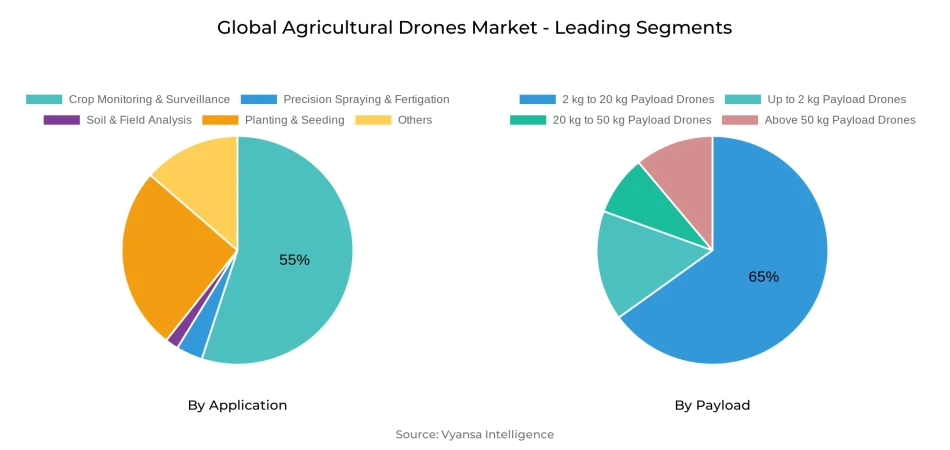

- Application Shares

- Crop Monitoring & Surveillance grabbed market share of 55%.

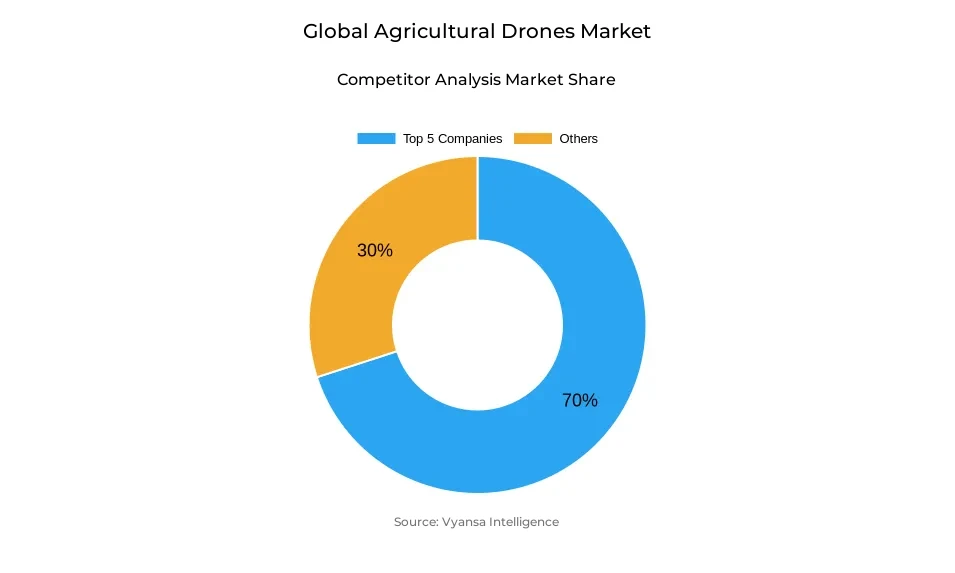

- Competition

- More than 20 companies are actively engaged in producing Agricultural Drones.

- Top 5 companies acquired 70% of the market share.

- AgEagle Aerial Systems Inc., PrecisionHawk, DroneDeploy, DJI, XAG Co., Ltd. etc., are few of the top companies.

- Payload

- 2 kg to 20 kg Payload Drones grabbed 65% of the market.

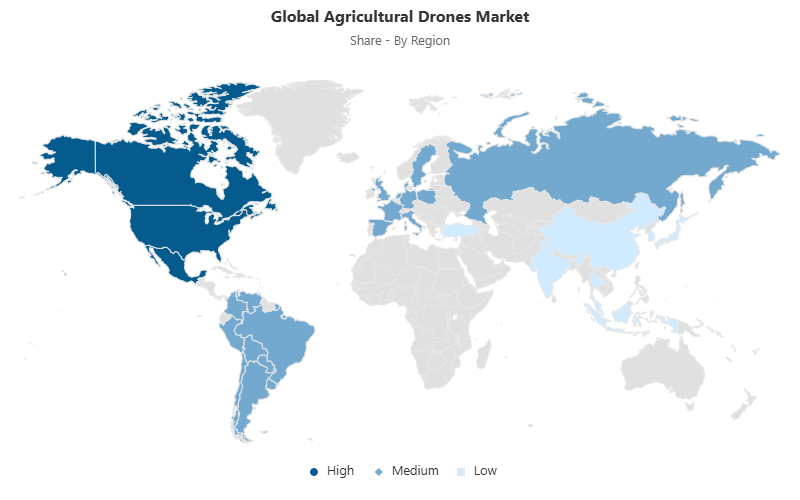

- Region

- North America leads with a 30% share of the Global Market.

Global Agricultural Drones Market Outlook

The Global Agricultural Drones Market, valued at $5.78 billion in 2025, is expected to grow robustly and touch $23.1 billion in 2032. The degradation of farm labor availability and the necessity to enhance productivity with fewer hands is fueling this robust growth. Drones are being used more commonly for crop monitoring, spraying, and field evaluations, which cut down manual effort and facilitate timely interventions. Supportive policies and technological advancements are further accelerating their adoption, making drones an essential part of modern farming.

Crop monitoring and surveillance represent the biggest share at 55% of the market. End users use aerial imaging to identify crop stress, infestations by pests, and soil health, facilitating quicker and more accurate interventions. This information assists farmers in minimizing the use of chemicals and safeguarding the yields, providing an unambiguous return on investment. With integration into farm management platforms, this segment is reinforced, as UAVs provide real-time information for farmers to make quick changes in practices.

As far as payload capacity goes, drones with payloads of 2 kg to 20 kg occupy 65% of the market share. Such UAVs are perfectly balanced in terms of stamina and operational effectiveness, thus proving ideal for both spraying and imaging-related tasks. Their versatility enables operators to alternate between crop protection and monitoring tasks, leading to wider applicability and increased efficiency. Such agility makes mid-weight drones the first choice among agricultural communities.

Geographically, North America dominates the industry with a 30% market share, buoyed by sophisticated precision-agriculture infrastructure and robust research collaborations. Government initiatives and clearly established regulations also push faster adoption, while the availability of top drone technology providers enhances innovation. Such an ecosystem provides the region's farmers with a competitive advantage in embracing improved aerial solutions, solidifying North America as a world leader in agricultural drone adoption.

Global Agricultural Drones Market Growth Driver

Rising Adoption Supported by Labor Shortages and Technological Advances

One of the key drivers of agricultural drone uptake is declining farm labor supply, with this driving a strong imperative to automate. The United States lost over 141,000 farms between 2017 and 2022, highlighting the need to gain more productivity with fewer laborers. Drones fill this void by undertaking crop monitoring, spraying, and field evaluation with more efficiency. Positive policies, for instance, FAA exemptions under Part 137, have reduced barriers to entry and promoted wider deployment of UAVs in agricultural activities.

Advancements in drone technology further accelerate this momentum. High-resolution multispectral imaging allows for faster, more accurate data collection, enabling farmers to detect crop stress and intervene early. UAVs can cover up to 200 hectares in just 30 minutes compared to 7 hectares per day manually, drastically improving efficiency. As workforce shortages persist, drones have become indispensable tools for yield maintenance and sustainable farming practices.

Global Agricultural Drones Market Challenge

Obstacles Arising from Pest Pressures and Regulatory Complexity

Crop pests and diseases remain a burden on agriculture production, with estimated global losses of close to 40% per year. Conventional scouting techniques are still time consuming and tend to miss early infestations, causing large-scale damage and heightened dependence on blanket spraying using pesticides. This inefficiency lowers production and increases cost of inputs, pushing end users to demand more accurate solutions where UAVs might be a game-changer.

Regulatory impediments compound the limitations, particularly for the smaller producers. Although FAA Part 137 exemptions do exist, the process of certification is still costly for most operators. This restricts access to drone technology for smallholders who frequently do not have capital and technical capability. Bridging over these barriers with simplified training schemes, transparent compliance pathways, and cost-effective aerial services will be instrumental in ensuring UAV uptake spreads across farms of all sizes.

Global Agricultural Drones Market Trend

Transformation Through Precision Mapping and AI Integration

The incorporation of cutting-edge mapping technology is redefining contemporary agriculture. LiDAR and multispectral sensor-capable drones provide accurate field information, including soil heterogeneity, nutrient deprivation, and moisture levels. Maps based on data drive variable-rate input applications, maximizing the use of fertilizer and water while minimizing waste. This precision mapping feature improves efficiency, resulting in more yields with less.

Machine learning and artificial intelligence continue to enhance UAV uses by allowing decision-making. Deep-learning algorithms analyze aerial imagery and mark areas of crop stress almost in real time, enabling timely, focused treatments. These quick insights accelerate response times and enhance farming management. With increasingly cheap and pervasive AI-powered analytics, drones are transforming from add-ons to a key part of precision farming systems.

Global Agricultural Drones Market Opportunity

Expanding Prospects Through Service-Based Models and Partnerships

Service-based models are opening up new growth opportunities by bringing drone technology to smallholders. The drone-as-a-service (DaaS) model enables cooperatives and rural entrepreneurs to offer aerial imaging, spraying, and analytical services without farmers having to make significant initial investments. This provides democratized access to technology and guarantees that even poor end users can partake in advanced precision technologies.

The collaborative initiatives between private and public agencies are also supporting UAV adoption. For instance, the FAO's efforts in Mongolia have provided evidence that crop loss due to pests can be minimized by up to 30% through drone-based surveillance and targeted intervention. Extending similar collaborative models across the world can enhance food security alongside ensuring sustainable agricultural practices. They hold vast potential to help large-scale expansion of agricultural drone services across emerging economies.

Global Agricultural Drones Market Regional Analysis

By Region

- North America

- Latin America

- Europe

- Middle East & Africa

- Asia-Pacific

North America has the top position in the region with a 30% market share of global agricultural drones. The region has the advantage of high precision-agriculture infrastructure, large amounts of R&D spending, and high-level adoption of AI and robotics technologies. Good UAV regulations along with government support initiatives, such as grants and extension services, also drive the development of drones for integration into mainstream farming.

Also, the fact that key technology providers have a presence and have good relationships with research organizations builds innovation and deployment. North American farmers have access to superior aerial solutions for spraying, monitoring, and data-based decision-making more quickly than other parts of the world. This highly developed ecosystem fortifies leadership in North America and acts as a benchmark for agricultural drone adoption across the globe.

Global Agricultural Drones Market Segmentation Analysis

By Application

- Crop Monitoring & Surveillance

- Precision Spraying & Fertigation

- Soil & Field Analysis

- Planting & Seeding

- Others

Crop monitoring and surveillance account for the greatest application segment with a market share of 55%. Farmers use aerial imaging to assess plant health, detect pest infestations, and check soil moisture levels to apply timely interventions. This early detection feature provides unequivocal returns on investment by avoiding yield losses and reducing excessive chemical use. The dominance of the segment is amplified by its ability to enhance decision-making and enhance productivity.

Moreover, monitoring software integrates perfectly into digital farm management platforms. UAVs deliver real-time NDVI and vegetative indices, which are visualized using interactive dashboards. Such a integration enables end users to monitor field conditions in real time and change practices dynamically. The close synergy between crop monitoring functionalities and farm management systems solidifies leadership for this segment in the agriculture drone market.

By Payload

- Up to 2 kg Payload Drones

- 2 kg to 20 kg Payload Drones

- 20 kg to 50 kg Payload Drones

- Above 50 kg Payload Drones

Of payload categories, 2-20 kg capacity drones take the lion's share with 65% of the market. Mid-range UAVs balance endurance with payload, making them all-purpose for imaging as well as spraying operations. Tank capacities of between 10 and 20 liters allow them to treat multiple hectares per mission, saving considerable operation downtime and manpower costs.

Their versatility also adds to market supremacy. Operators can interchange payload types, e.g., multispectral high-resolution cameras for surveillance or crop protection chemical sprayers. This versatility optimizes the use of drones and provides an economical solution to a broad spectrum of agricultural applications. The combination of long runtime, versatility, and operation efficiency ensures that mid-weight drones are the most desired by end users.

Top Companies in Global Agricultural Drones Market

The top companies operating in the market include AgEagle Aerial Systems Inc., PrecisionHawk, DroneDeploy, DJI, XAG Co., Ltd., Parrot Drone SAS, AeroVironment, Inc., Trimble Inc., Autel Robotics, Sentera, Draganfly Inc., Pix4D SA, Yamaha Motor Co., Ltd., Sky-Drones Technologies Ltd, Microdrones GmbH, etc., are the top players operating in the Global Agricultural Drones Market.

Frequently Asked Questions

Related Report

- Market Segmentation

- Research Scope

- Research Methodology

- Definitions and Assumptions

- Executive Summary

- Global Agricultural Drones Market Policies, Regulations, and Standards

- Global Agricultural Drones Market Dynamics

- Growth Factors

- Challenges

- Trends

- Opportunities

- Global Agricultural Drones Market Statistics, 2022-2032F

- Market Size & Growth Outlook

- By Revenues in US$ Million

- By Units Sold in Thousand Units

- Market Segmentation & Growth Outlook

- By Offering

- Hardware- Market Insights and Forecast 2022-2032, USD Million

- UAV Frames & Airframes- Market Insights and Forecast 2022-2032, USD Million

- Fixed-Wing Drones- Market Insights and Forecast 2022-2032, USD Million

- Rotary Blade Drones- Market Insights and Forecast 2022-2032, USD Million

- Hybrid Drones- Market Insights and Forecast 2022-2032, USD Million

- Propulsion Systems- Market Insights and Forecast 2022-2032, USD Million

- Payload Systems- Market Insights and Forecast 2022-2032, USD Million

- Cameras- Market Insights and Forecast 2022-2032, USD Million

- Multispectral- Market Insights and Forecast 2022-2032, USD Million

- LiDAR Sensors- Market Insights and Forecast 2022-2032, USD Million

- Spray Systems & Nozzles- Market Insights and Forecast 2022-2032, USD Million

- UAV Frames & Airframes- Market Insights and Forecast 2022-2032, USD Million

- Software- Market Insights and Forecast 2022-2032, USD Million

- Flight Planning & Control Software- Market Insights and Forecast 2022-2032, USD Million

- Data Analytics Platforms- Market Insights and Forecast 2022-2032, USD Million

- Crop Health Monitoring Tools- Market Insights and Forecast 2022-2032, USD Million

- Services- Market Insights and Forecast 2022-2032, USD Million

- Maintenance & Repair- Market Insights and Forecast 2022-2032, USD Million

- Training & Support- Market Insights and Forecast 2022-2032, USD Million

- Data Interpretation & Consultancy- Market Insights and Forecast 2022-2032, USD Million

- Hardware- Market Insights and Forecast 2022-2032, USD Million

- By Application

- Crop Monitoring & Surveillance- Market Insights and Forecast 2022-2032, USD Million

- Aerial Imaging- Market Insights and Forecast 2022-2032, USD Million

- Multispectral & Hyperspectral Analysis- Market Insights and Forecast 2022-2032, USD Million

- NDVI Mapping- Market Insights and Forecast 2022-2032, USD Million

- Precision Spraying & Fertigation- Market Insights and Forecast 2022-2032, USD Million

- Pesticide Application- Market Insights and Forecast 2022-2032, USD Million

- Fertilizer Distribution- Market Insights and Forecast 2022-2032, USD Million

- Targeted Herbicide Spraying- Market Insights and Forecast 2022-2032, USD Million

- Soil & Field Analysis- Market Insights and Forecast 2022-2032, USD Million

- Soil Moisture Mapping- Market Insights and Forecast 2022-2032, USD Million

- Topography & Field Mapping- Market Insights and Forecast 2022-2032, USD Million

- Planting & Seeding- Market Insights and Forecast 2022-2032, USD Million

- Drone-based Seeding Systems- Market Insights and Forecast 2022-2032, USD Million

- Automated Seed Disbursement- Market Insights and Forecast 2022-2032, USD Million

- Others- Market Insights and Forecast 2022-2032, USD Million

- Livestock Monitoring- Market Insights and Forecast 2022-2032, USD Million

- Soil Health Analytics- Market Insights and Forecast 2022-2032, USD Million

- Research & Development Applications- Market Insights and Forecast 2022-2032, USD Million

- Crop Monitoring & Surveillance- Market Insights and Forecast 2022-2032, USD Million

- By Payload

- Up to 2 kg Payload Drones- Market Insights and Forecast 2022-2032, USD Million

- 2 kg to 20 kg Payload Drones- Market Insights and Forecast 2022-2032, USD Million

- 20 kg to 50 kg Payload Drones- Market Insights and Forecast 2022-2032, USD Million

- Above 50 kg Payload Drones- Market Insights and Forecast 2022-2032, USD Million

- By Range

- Visual Line of Sight (VLOS)- Market Insights and Forecast 2022-2032, USD Million

- Beyond Visual Line of Sight (BVLOS)- Market Insights and Forecast 2022-2032, USD Million

- By Technology Type

- Thermal Imaging- Market Insights and Forecast 2022-2032, USD Million

- Multispectral Imaging- Market Insights and Forecast 2022-2032, USD Million

- Hyperspectral Imaging- Market Insights and Forecast 2022-2032, USD Million

- Light Detection and Ranging (LiDAR)- Market Insights and Forecast 2022-2032, USD Million

- RGB Imaging- Market Insights and Forecast 2022-2032, USD Million

- Synthetic Aperture Radar (SAR)- Market Insights and Forecast 2022-2032, USD Million

- Near-Infrared (NIR) Imaging- Market Insights and Forecast 2022-2032, USD Million

- Global Navigation Satellite System (GNSS)- Market Insights and Forecast 2022-2032, USD Million

- By Region

- North America

- Latin America

- Europe

- Middle East & Africa

- Asia-Pacific

- By Competitors

- Competition Characteristics

- Market Share & Analysis

- By Offering

- Market Size & Growth Outlook

- North America Agricultural Drones Market Statistics, 2022-2032F

- Market Size & Growth Outlook

- By Revenues in US$ Million

- By Units Sold in Thousand Units

- Market Segmentation & Growth Outlook

- By Offering- Market Insights and Forecast 2022-2032, USD Million

- By Application- Market Insights and Forecast 2022-2032, USD Million

- By Payload- Market Insights and Forecast 2022-2032, USD Million

- By Range- Market Insights and Forecast 2022-2032, USD Million

- By Technology Type- Market Insights and Forecast 2022-2032, USD Million

- By Country

- USA

- Canada

- Mexico

- Rest of North America

- USA Agricultural Drones Market Statistics, 2022-2032F

- Market Size & Growth Outlook

- By Revenues in US$ Million

- By Units Sold in Thousand Units

- Market Segmentation & Growth Outlook

- By Offering- Market Insights and Forecast 2022-2032, USD Million

- By Application- Market Insights and Forecast 2022-2032, USD Million

- Market Size & Growth Outlook

- Canada Agricultural Drones Market Statistics, 2022-2032F

- Market Size & Growth Outlook

- By Revenues in US$ Million

- By Units Sold in Thousand Units

- Market Segmentation & Growth Outlook

- By Offering- Market Insights and Forecast 2022-2032, USD Million

- By Application- Market Insights and Forecast 2022-2032, USD Million

- Market Size & Growth Outlook

- Mexico Agricultural Drones Market Statistics, 2022-2032F

- Market Size & Growth Outlook

- By Revenues in US$ Million

- By Units Sold in Thousand Units

- Market Segmentation & Growth Outlook

- By Offering- Market Insights and Forecast 2022-2032, USD Million

- By Application- Market Insights and Forecast 2022-2032, USD Million

- Market Size & Growth Outlook

- Market Size & Growth Outlook

- Latin America Agricultural Drones Market Statistics, 2022-2032F

- Market Size & Growth Outlook

- By Revenues in US$ Million

- By Units Sold in Thousand Units

- Market Segmentation & Growth Outlook

- By Offering- Market Insights and Forecast 2022-2032, USD Million

- By Application- Market Insights and Forecast 2022-2032, USD Million

- By Payload- Market Insights and Forecast 2022-2032, USD Million

- By Range- Market Insights and Forecast 2022-2032, USD Million

- By Technology Type- Market Insights and Forecast 2022-2032, USD Million

- By Country

- Brazil

- Argentina

- Rest of Latin America

- Brazil Agricultural Drones Market Statistics, 2022-2032F

- Market Size & Growth Outlook

- By Revenues in US$ Million

- By Units Sold in Thousand Units

- Market Segmentation & Growth Outlook

- By Offering- Market Insights and Forecast 2022-2032, USD Million

- By Application- Market Insights and Forecast 2022-2032, USD Million

- Market Size & Growth Outlook

- Argentina Agricultural Drones Market Statistics, 2022-2032F

- Market Size & Growth Outlook

- By Revenues in US$ Million

- By Units Sold in Thousand Units

- Market Segmentation & Growth Outlook

- By Offering- Market Insights and Forecast 2022-2032, USD Million

- By Application- Market Insights and Forecast 2022-2032, USD Million

- Market Size & Growth Outlook

- Market Size & Growth Outlook

- Europe Agricultural Drones Market Statistics, 2022-2032F

- Market Size & Growth Outlook

- By Revenues in US$ Million

- By Units Sold in Thousand Units

- Market Segmentation & Growth Outlook

- By Offering- Market Insights and Forecast 2022-2032, USD Million

- By Application- Market Insights and Forecast 2022-2032, USD Million

- By Payload- Market Insights and Forecast 2022-2032, USD Million

- By Range- Market Insights and Forecast 2022-2032, USD Million

- By Technology Type- Market Insights and Forecast 2022-2032, USD Million

- By Country

- UK

- Germany

- France

- Spain

- Italy

- Rest of Europe

- UK Agricultural Drones Market Statistics, 2022-2032F

- Market Size & Growth Outlook

- By Revenues in US$ Million

- By Units Sold in Thousand Units

- Market Segmentation & Growth Outlook

- By Offering- Market Insights and Forecast 2022-2032, USD Million

- By Application- Market Insights and Forecast 2022-2032, USD Million

- Market Size & Growth Outlook

- Germany Agricultural Drones Market Statistics, 2022-2032F

- Market Size & Growth Outlook

- By Revenues in US$ Million

- By Units Sold in Thousand Units

- Market Segmentation & Growth Outlook

- By Offering- Market Insights and Forecast 2022-2032, USD Million

- By Application- Market Insights and Forecast 2022-2032, USD Million

- Market Size & Growth Outlook

- France Agricultural Drones Market Statistics, 2022-2032F

- Market Size & Growth Outlook

- By Revenues in US$ Million

- By Units Sold in Thousand Units

- Market Segmentation & Growth Outlook

- By Offering- Market Insights and Forecast 2022-2032, USD Million

- By Application- Market Insights and Forecast 2022-2032, USD Million

- Market Size & Growth Outlook

- Spain Agricultural Drones Market Statistics, 2022-2032F

- Market Size & Growth Outlook

- By Revenues in US$ Million

- By Units Sold in Thousand Units

- Market Segmentation & Growth Outlook

- By Offering- Market Insights and Forecast 2022-2032, USD Million

- By Application- Market Insights and Forecast 2022-2032, USD Million

- Market Size & Growth Outlook

- Italy Agricultural Drones Market Statistics, 2022-2032F

- Market Size & Growth Outlook

- By Revenues in US$ Million

- By Units Sold in Thousand Units

- Market Segmentation & Growth Outlook

- By Offering- Market Insights and Forecast 2022-2032, USD Million

- By Application- Market Insights and Forecast 2022-2032, USD Million

- Market Size & Growth Outlook

- Market Size & Growth Outlook

- Middle East & Africa Agricultural Drones Market Statistics, 2022-2032F

- Market Size & Growth Outlook

- By Revenues in US$ Million

- By Units Sold in Thousand Units

- Market Segmentation & Growth Outlook

- By Offering- Market Insights and Forecast 2022-2032, USD Million

- By Application- Market Insights and Forecast 2022-2032, USD Million

- By Payload- Market Insights and Forecast 2022-2032, USD Million

- By Range- Market Insights and Forecast 2022-2032, USD Million

- By Technology Type- Market Insights and Forecast 2022-2032, USD Million

- By Country

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East & Africa

- UAE Agricultural Drones Market Statistics, 2022-2032F

- Market Size & Growth Outlook

- By Revenues in US$ Million

- By Units Sold in Thousand Units

- Market Segmentation & Growth Outlook

- By Offering- Market Insights and Forecast 2022-2032, USD Million

- By Application- Market Insights and Forecast 2022-2032, USD Million

- Market Size & Growth Outlook

- Saudi Arabia Agricultural Drones Market Statistics, 2022-2032F

- Market Size & Growth Outlook

- By Revenues in US$ Million

- By Units Sold in Thousand Units

- Market Segmentation & Growth Outlook

- By Offering- Market Insights and Forecast 2022-2032, USD Million

- By Application- Market Insights and Forecast 2022-2032, USD Million

- Market Size & Growth Outlook

- South Africa Agricultural Drones Market Statistics, 2022-2032F

- Market Size & Growth Outlook

- By Revenues in US$ Million

- By Units Sold in Thousand Units

- Market Segmentation & Growth Outlook

- By Offering- Market Insights and Forecast 2022-2032, USD Million

- By Application- Market Insights and Forecast 2022-2032, USD Million

- Market Size & Growth Outlook

- Market Size & Growth Outlook

- Asia-Pacific Agricultural Drones Market Statistics, 2022-2032F

- Market Size & Growth Outlook

- By Revenues in US$ Million

- By Units Sold in Thousand Units

- Market Segmentation & Growth Outlook

- By Offering- Market Insights and Forecast 2022-2032, USD Million

- By Application- Market Insights and Forecast 2022-2032, USD Million

- By Payload- Market Insights and Forecast 2022-2032, USD Million

- By Range- Market Insights and Forecast 2022-2032, USD Million

- By Technology Type- Market Insights and Forecast 2022-2032, USD Million

- By Country

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia-Pacific

- China Agricultural Drones Market Statistics, 2022-2032F

- Market Size & Growth Outlook

- By Revenues in US$ Million

- By Units Sold in Thousand Units

- Market Segmentation & Growth Outlook

- By Offering- Market Insights and Forecast 2022-2032, USD Million

- By Application- Market Insights and Forecast 2022-2032, USD Million

- Market Size & Growth Outlook

- India Agricultural Drones Market Statistics, 2022-2032F

- Market Size & Growth Outlook

- By Revenues in US$ Million

- By Units Sold in Thousand Units

- Market Segmentation & Growth Outlook

- By Offering- Market Insights and Forecast 2022-2032, USD Million

- By Application- Market Insights and Forecast 2022-2032, USD Million

- Market Size & Growth Outlook

- Japan Agricultural Drones Market Statistics, 2022-2032F

- Market Size & Growth Outlook

- By Revenues in US$ Million

- By Units Sold in Thousand Units

- Market Segmentation & Growth Outlook

- By Offering- Market Insights and Forecast 2022-2032, USD Million

- By Application- Market Insights and Forecast 2022-2032, USD Million

- Market Size & Growth Outlook

- Australia Agricultural Drones Market Statistics, 2022-2032F

- Market Size & Growth Outlook

- By Revenues in US$ Million

- By Units Sold in Thousand Units

- Market Segmentation & Growth Outlook

- By Offering- Market Insights and Forecast 2022-2032, USD Million

- By Application- Market Insights and Forecast 2022-2032, USD Million

- Market Size & Growth Outlook

- South Korea Agricultural Drones Market Statistics, 2022-2032F

- Market Size & Growth Outlook

- By Revenues in US$ Million

- By Units Sold in Thousand Units

- Market Segmentation & Growth Outlook

- By Offering- Market Insights and Forecast 2022-2032, USD Million

- By Application- Market Insights and Forecast 2022-2032, USD Million

- Market Size & Growth Outlook

- Market Size & Growth Outlook

- Competitive Outlook

- Company Profiles

- DJI

- Business Description

- Product Portfolio

- Collaborations & Alliances

- Recent Developments

- Financial Details

- Others

- XAG Co., Ltd.

- Business Description

- Product Portfolio

- Collaborations & Alliances

- Recent Developments

- Financial Details

- Others

- Parrot Drone SAS

- Business Description

- Product Portfolio

- Collaborations & Alliances

- Recent Developments

- Financial Details

- Others

- AeroVironment, Inc.

- Business Description

- Product Portfolio

- Collaborations & Alliances

- Recent Developments

- Financial Details

- Others

- Trimble Inc.

- Business Description

- Product Portfolio

- Collaborations & Alliances

- Recent Developments

- Financial Details

- Others

- AgEagle Aerial Systems Inc.

- Business Description

- Product Portfolio

- Collaborations & Alliances

- Recent Developments

- Financial Details

- Others

- PrecisionHawk

- Business Description

- Product Portfolio

- Collaborations & Alliances

- Recent Developments

- Financial Details

- Others

- DroneDeploy

- Business Description

- Product Portfolio

- Collaborations & Alliances

- Recent Developments

- Financial Details

- Others

- Autel Robotics

- Business Description

- Product Portfolio

- Collaborations & Alliances

- Recent Developments

- Financial Details

- Others

- Sentera

- Business Description

- Product Portfolio

- Collaborations & Alliances

- Recent Developments

- Financial Details

- Others

- Draganfly Inc.

- Business Description

- Product Portfolio

- Collaborations & Alliances

- Recent Developments

- Financial Details

- Others

- Pix4D SA

- Business Description

- Product Portfolio

- Collaborations & Alliances

- Recent Developments

- Financial Details

- Others

- Yamaha Motor Co., Ltd.

- Business Description

- Product Portfolio

- Collaborations & Alliances

- Recent Developments

- Financial Details

- Others

- Sky-Drones Technologies Ltd

- Business Description

- Product Portfolio

- Collaborations & Alliances

- Recent Developments

- Financial Details

- Others

- Microdrones GmbH

- Business Description

- Product Portfolio

- Collaborations & Alliances

- Recent Developments

- Financial Details

- Others

- DJI

- Company Profiles

- Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Offering |

|

| By Application |

|

| By Payload |

|

| By Range |

|

| By Technology Type |

|

| By Region |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.